401(k) Participants -

Know the History of Your Rights

Your Retirement. Your Money. Your Rights.

In America’s retirement system, you are generally responsible for saving, investing, and planning for your own retirement. To help you achieve a secure retirement, policymakers give you rights to manage your own money inside your 401(k) plan.

Only you can choose who helps with your 401(k), nobody else can choose for you.

With individual responsibility comes individual choice. While you can’t choose who holds your 401(k) – your employer makes that decision – the choice of who you go to for help managing your 401(k)s should only belong to you, and no one else. Not your employer, or the financial institution holding your 401(k).

Four Numbers to Know on the History of 401(k) Participant Rights:

Participants have sought help from their personal advisers for decades. Over time, regulators have provided support for participants making that choice.

-

1996-1: Right to Independent Advice

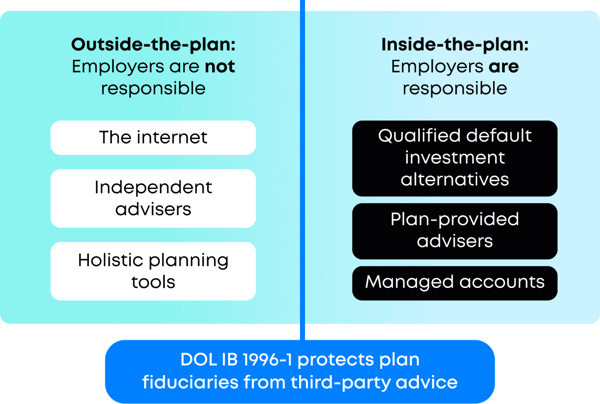

- In 1996, the Department of Labor published guidance saying plan sponsors are not responsible or liable for advice participants get from a third-party. Plan sponsors don’t want to be responsible for third-party advice – if they were, then a participant could potentially hold their plan sponsor liable for advice they got from the internet or from their own adviser.

- If you asked your plan sponsor if they were responsible for the third party advice on your 401k account, they will very likely tell you “no.” If the plan sponsors selected your financial advisor for your 401(k) account, they may be responsible for their advice under 1996-1.

-

404: Right to Fiduciary Care and Control

- Section 404 of the Employee Retirement Income Security Act of 1974 (ERISA) requires that plan sponsors act in the best interest of their participants and give participants control over their assets.

- If plan sponsors or their providers do not give participants adequate control, then they can potentially be considered liable for participants’ investing decisions.

-

206(4)-2: Right to Adviser Management

- People have asked their investment advisers to manage their 401(k) accounts, including by giving their advisers their login credentials. The SEC has supervised advisers taking client credentials and claiming custody over client 401(k)s since 2010.

- States also oversee advisers taking client credentials, and have rules making sure advisers protect their clients’ information and assets.

-

1033: Right to Share Information

-

- After the 2008 Financial Crisis, Congress passed the Dodd-Frank Act, which includes Section 1033, giving consumers rights to access and share financial account information from their bank and credit card accounts.

- This right empowers over 150 million Americans to connect their financial accounts to useful digital tools they use to pay the babysitter, file taxes, and share information with their financial advisers.

How 401(k) advice works

People can choose to get advice either “inside their 401(k) plan” or “outside their 401(k) plan.” This is why the Department of Labor issued its 1996 guidance, to help clarify the difference and to ensure that employers aren’t open to liability for investment advice that their workers get outside the plan.

In-Plan

- Qualified Default Investment Alternative: Plans are allowed to set default funds where your money is automatically invested if you don’t choose another fund. In this case, the plan is making an investment decision for you.

- Personal adviser: Your plan or recordkeeper might offer you individualized help, for a fee. This could include virtual or in-person visits, and active management of your account.

- Managed accounts: Your plan might offer a managed accounts service on its own or through a third-party. These services tend to ask you questions about risk tolerance, and design a portfolio for you.

Out-Of-Plan

-

Connecting your account to a dashboard that aggregates your financial information: Aggregating your financial information does not mean you are receiving financial advice, but many participants connect their 401(k) accounts to other services, to view all their information in one place, or facilitate their adviser’s management.

-

Printing out statements and walking into advisers’ office: Participants might have a regular check-in with their adviser, who can write down instructions for them.

-

Providing advisers your credentials: For at least fifteen years, participants have given their login credentials to fiduciary advisers, who claim custody over those assets because they can withdraw funds. As a reminder, when you use Pontera, your adviser does not have your credentials and cannot withdraw funds from your account.

The history of retirement planning puts the responsibility and the control of your personal retirement planning in your hands.

Based on this history, Pontera believes you deserve the freedom to choose how you receive guidance for your retirement planning:

- You can seek advice on your 401k account without needing approval from your employer.

- Your employer isn’t responsible for the advice you receive outside the workplace.

- You should feel empowered to make informed decisions about your own money.

**This page is provided for general information only and should not be deemed to be legal or financial advice. You should seek legal and financial advice from your trusted professional based on your own unique circumstances. This page contains links to information created and maintained by other public and private organizations. Please be aware that we do not control or guarantee the accuracy, relevance, timeliness, or completeness of this outside information.