About Pontera

The name Pontera was born out of our aspiration to be the bridge to better retirement.

We deliver a secure and seamless platform for financial advisors to manage 401(k) and other held away accounts.

Our mission

Pontera is dedicated to helping individuals retire with greater wealth and financial security. Founded in 2012, we work with Registered Investment Advisors (RIAs), Broker-Dealers, and some of the largest financial institutions in the country.

Our team

Pontera has put together a team committed to building solutions for age-old challenges. We are a diverse, customer-focused team of problem solvers, creative thinkers, engineers and financial services veterans focused on finding solutions that benefit everyone.

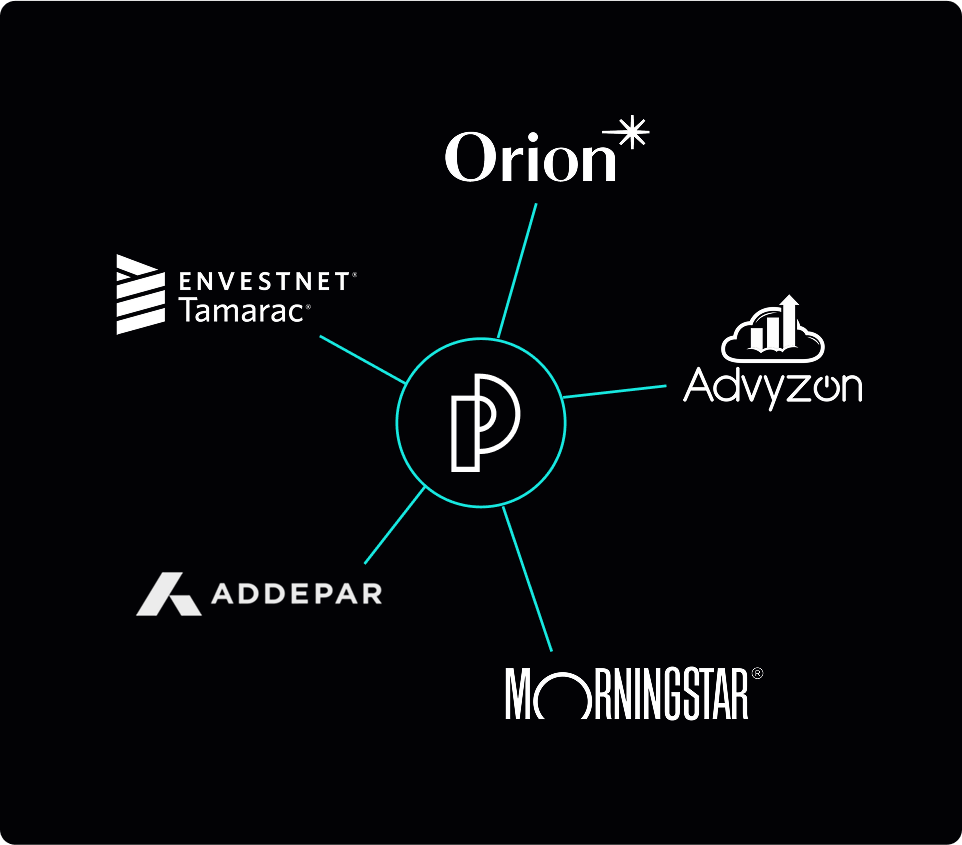

Our partners

Pontera has built partnerships with some of the largest firms in the financial services industry and major providers of wealth management software. We are open to new engagements that align with our mission to create better retirement outcomes.

Our investors