Retirement savers

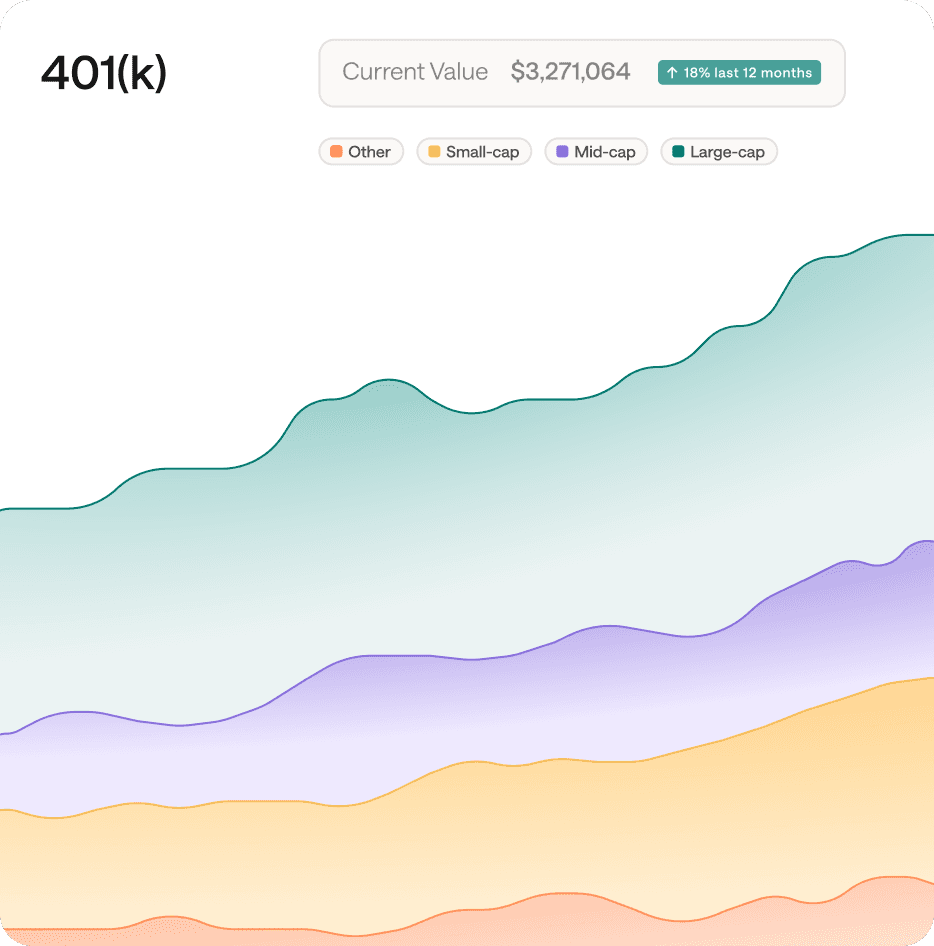

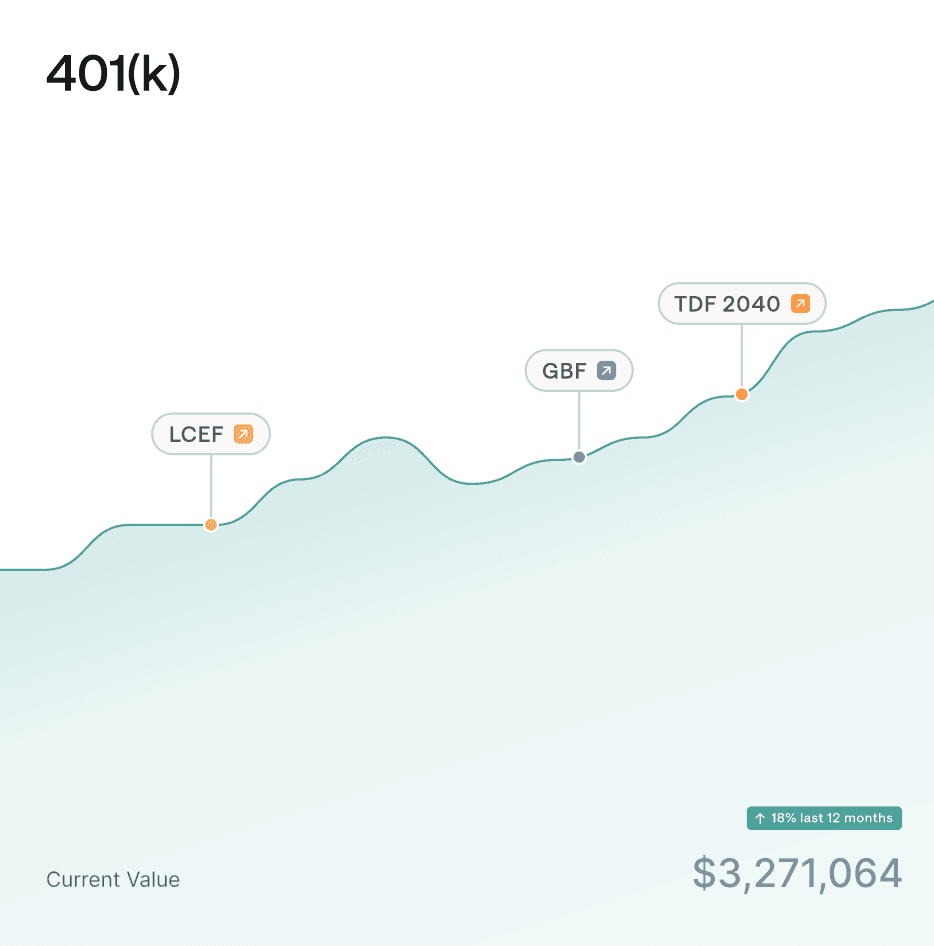

Your advisor can monitor and adjust your retirement accounts—without rolling them over—so your money works for your unique goals.

Get guidance from your trusted advisor where it matters most

The median American holds nearly half of their net worth in their retirement plan.1 Make sure your hard-earned retirement funds aren’t outside of your advisor’s purview.

Frequently asked questions

How does Pontera keep my account safe?

With Pontera, an advisor never has access to your login credentials. Pontera only allows advisors to take specific actions; in our case, they can only view and rebalance your account. Advisors cannot use Pontera to withdraw or transfer funds, change beneficiaries or contributions, or initiate distributions.

What types of accounts can my advisor manage?

Advisors can manage many employer-sponsored retirement accounts with Pontera, including 401(k)s, 401(a)s, 403(b)s, 457s, TSPs, and 529s.

Will I still have control over my account?

Yes. Your advisor can manage your investments, but you and only you retain ownership, control, and full access to your funds.

What is the benefit of using Pontera?

Pontera empowers your advisor to customize strategies to your unique goals, timeline, and risk tolerance.

Can my advisor manage accounts from my former employers?

Yes. With Pontera, you can maintain the benefits of your previous plan — including lower fees and institutional funds — which could ordinarily be lost through a rollover.