Lack of control

Only about one-third of retirement savers feel like they have a lot of control in actively making decisions over their investment portfolios.

Savers' top challenge

The rising cost of living and inflation are the #1 concerns across all generations.

Advisors drive better outcomes

Savers with an advisor are more than 2x as likely to have over $250,000 in retirement savings than those without an advisor.

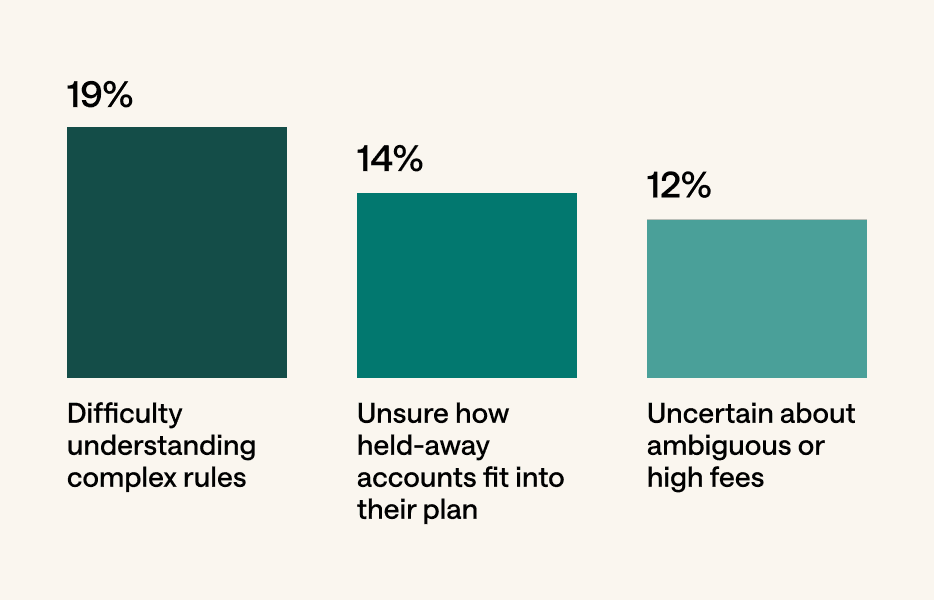

Account complexity

Financial advisors say that the complexity of rules and restrictions surrounding plans is the biggest challenge their clients face.

Savers want help

91% of financial advisors say that offering services for held-away accounts has increased demand for their services.