PONTERA FOR RECORDKEEPERS

Pontera connects plan participants to their own trusted financial advisors for secure 401(k) oversight and reallocation.

Improve participant outcomes

Approximately one third of Americans are already working with financial advisors to grow their families' household wealth. But oftentimes, individuals cannot get the same level of oversight and professional guidance on their 401(k)s as they could for their other assets. Additionally, studies show that professionally-managed retirement accounts generate 3-4% higher returns per year, net of fees, than self-managed accounts.2 With Pontera, participants who already have a trusted advisor have the option to receive the same level of service from their financial advisors on their 401(k) as they do with other accounts.

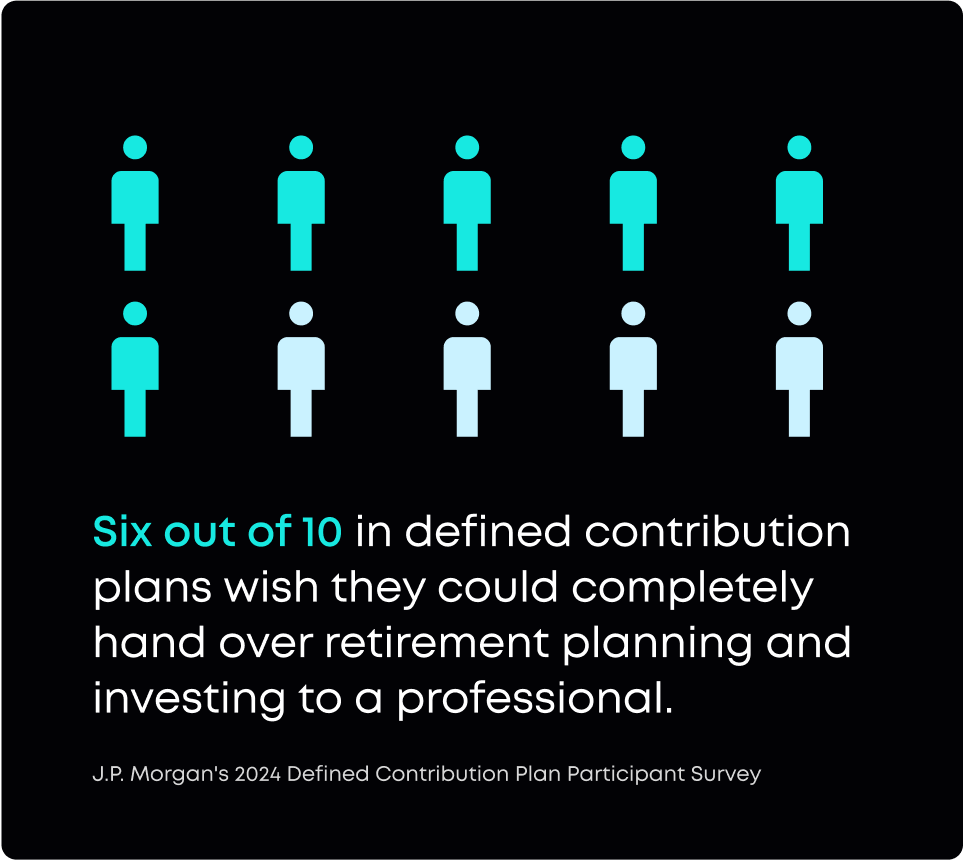

Premier advisory services for participants who need it

The demand for personalized advice on retirement accounts is on the rise.* Pontera offers a solution for advisors whose clients want bespoke in-plan management services for their in-plan accounts. This represents another opportunity for recordkeepers and plan advisors to deliver high value offerings to participants.

Minimize leakage

Participants frequently roll over their assets to an IRA because their trusted advisor is unable to securely oversee or reallocate their plan accounts, even when faced with higher expenses, lower quality fund options, and potential losses of creditor protection.

Pontera complements—not replaces— the existing solutions that you provide. Pontera can holistically extend the value of the plan’s existing design by enabling participants to receive professional advice in-plan from the advisors they already trust, directly solving the driver of rollover and maximizing the value of the high-quality features you provide.

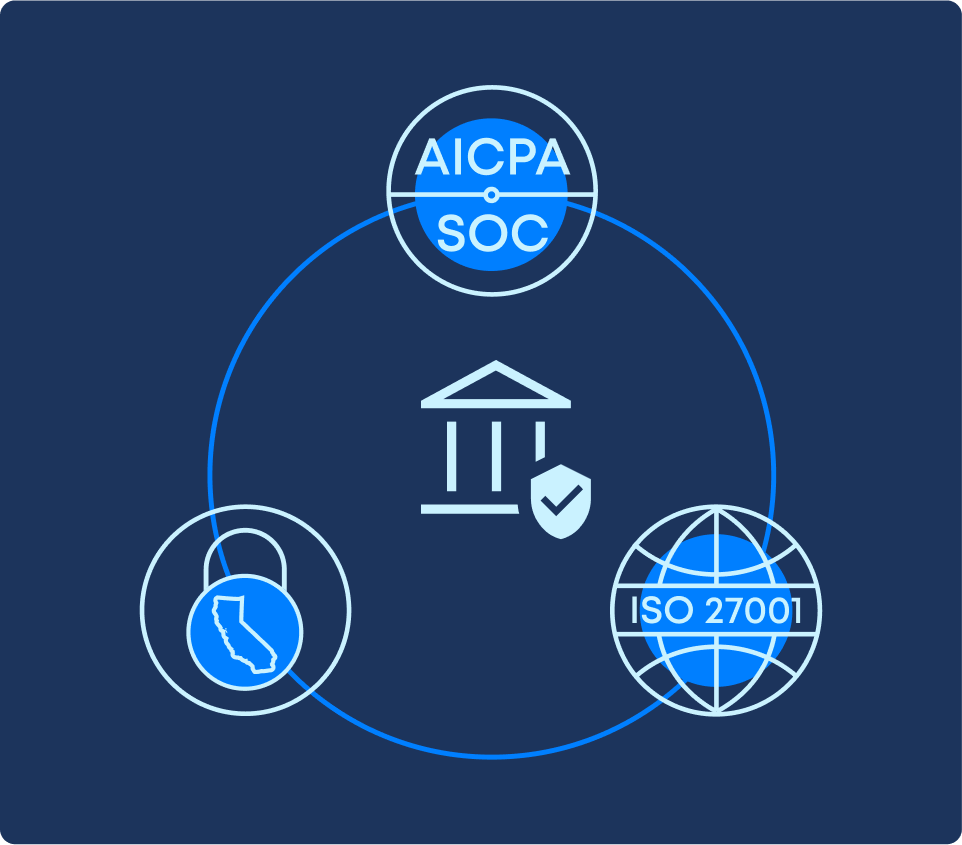

Better security practices

For years, financial advisors have directly accessed client 401(k) accounts via the recordkeeper's website to provide comprehensive management services. Without proper safeguards like Pontera,this practice posed potential cybersecurity risk to participants, advisors, and recordkeepers. Pontera improves such processes by offering a protective barrier to the client's account and an auditable trade blotter. The Pontera platform uses bank-level encryption, is SOC 2 certified by EY, is subject to regular penetration testing, and restricts advisor actions to investment management without ability to withdraw funds, change beneficiaries or otherwise divert any funds.

Disclaimer

With Pontera, an advisor never holds, either directly or indirectly, client funds or securities or has any authority to obtain possession of them. Pontera’s platform is purpose-built to avoid activities that can trigger custody. An advisor never has access to clients’ login credentials when using Pontera. Similar to other data aggregators that are widely used by advisors to connect with their clients’ held-away accounts, Pontera only allows the advisors to take specific actions – in our case, to view and rebalance a client’s account. Advisors cannot use Pontera to engage in activities that could trigger custody, such as withdraw or transfer funds, change beneficiaries or contributions, or initiate distributions.