Pontera for retirement savers

With Pontera, your trusted financial advisor can help you plan for a better retirement.

Achieve your retirement goals

You’ve worked hard to build up your savings.

Make your savings work for you.

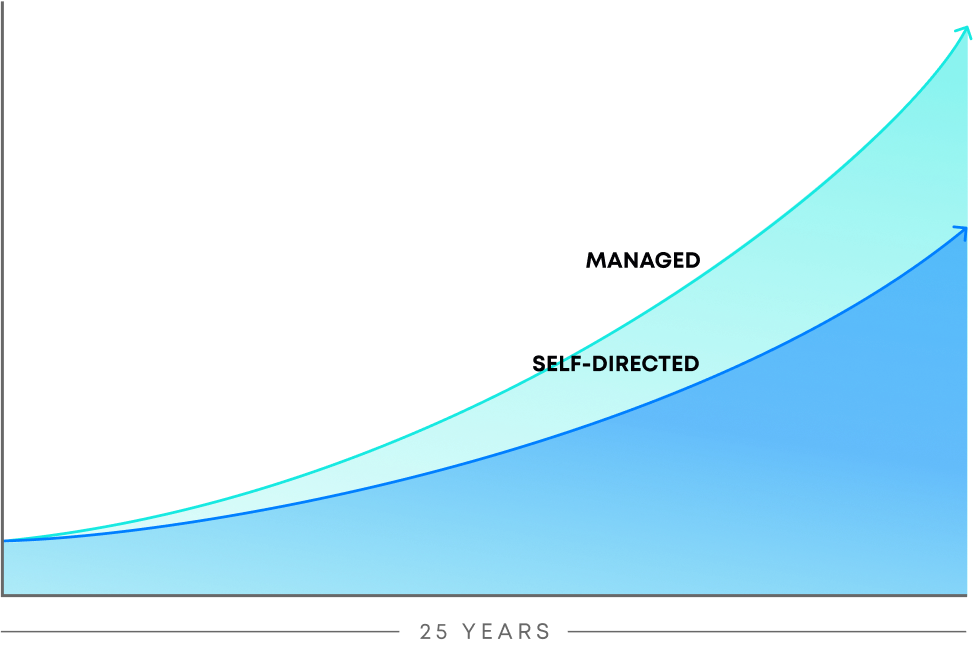

Studies show that professionally managed accounts generate 3-4% higher returns per year, net of fees, than investors’ self-managed accounts.1 When you connect your accounts to Pontera, you enable your trusted advisor to provide tailored financial guidance.

Conquer information overload

Effectively managing your investments and making informed financial decisions takes time, skill, and effort. You’ve hired your financial advisor to provide professional guidance, but there has been an important piece missing–the ability for your advisor to oversee your 401(k).

With Pontera, your trusted wealth advisor gains the ability to proactively manage your 401(k) as part of your entire portfolio, so you can skip deciphering lengthy plan information and fund options on your own.

Unlock your saving potential

Managing your 401(k) accounts separately from the rest of your assets can create a siloed view that prevents you from taking full advantage of asset allocation and tax strategies. Pontera enables your advisor to holistically manage all of your financial accounts according to your personalized financial plan.

Achieve financial wellness

Life is full of unexpected changes, both at the personal and global level.

Whether celebrating a major milestone or navigating a volatile market, retirement savers tend to make better decisions in the face of uncertainty when working with a financial advisor. Pontera enables your financial advisor to proactively rebalance your accounts during market volatility, which can spell the difference between meeting your retirement goals or ultimately falling short.

Get peace of mind

Protecting your financial well-being is our top priority.

Pontera aims to ensure that retirement savers can receive the advice and support they need while their account remains secure. Pontera enables advisors to manage retirement accounts without direct account access, shared credentials, or the ability to withdraw funds.

In addition, Pontera is a SOC 2 certified business that uses the latest cybersecurity and data protection technologies to safeguard your financial account information. To learn more about how Pontera protects retirement savers, please read our Commitment to Client Protection.

.png?width=353&height=209&name=yoav-aziz-JdncZmN1-3E-unsplash%201%20(1).png)

What should I do with my 401(k) if I’m...

Confused by my plan options?

Read more >Managing it myself?

Read more >

Invested in target date funds?

Read more >.png?width=491&height=470&name=image%208%20(1).png)

Thinking about rolling it over?

Read more >