PONTERA FOR PLAN SPONSORS

Over one third of retirement savers work with a financial advisor.1

Pontera is helping participants attain trusted advice on their 401(k) and other plan accounts, too.

Provide an elevated participant experience: comprehensive retirement solutions and financial wellness.

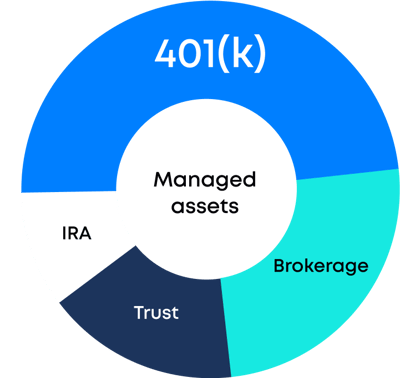

Prepare and support your participants through all walks of life, including market volatility or major life events that can lead to a reduction in contributions or withdrawals. Retirement plans offer a range of account management resources and tools, including target date funds and managed account services. For those participants who require more bespoke financial planning services, Pontera enables their trusted financial advisor to provide oversight and reallocation support within their plan accounts as part of a holistic investment strategy.

Financial advisors who leverage Pontera can help plan participants make better decisions about their financial wellness and stay the course to reaching their retirement goals. By supporting this capability, you help participants make better decisions, stay on track toward their retirement goals, and enhance the quality of their experience within your plan, providing a valuable benefit at no added cost or changes to the existing plan.

Professional help from personal financial advisors that can lead to better retirement outcomes for your participants.

Over half of retirement plan participants feel they are presented with more information than they can absorb and think employers should provide access to financial professionals to help.1 Pontera is already bridging this need for thousands of plan participants and their advisors. Studies show that professionally managed retirement accounts generate an average of 3-4% higher returns per year, net of fees, than investors’ self-managed accounts.1 In other words, participants using Pontera can benefit from enhanced visibility and professional oversight of their plan accounts.

Best-in-class security practices

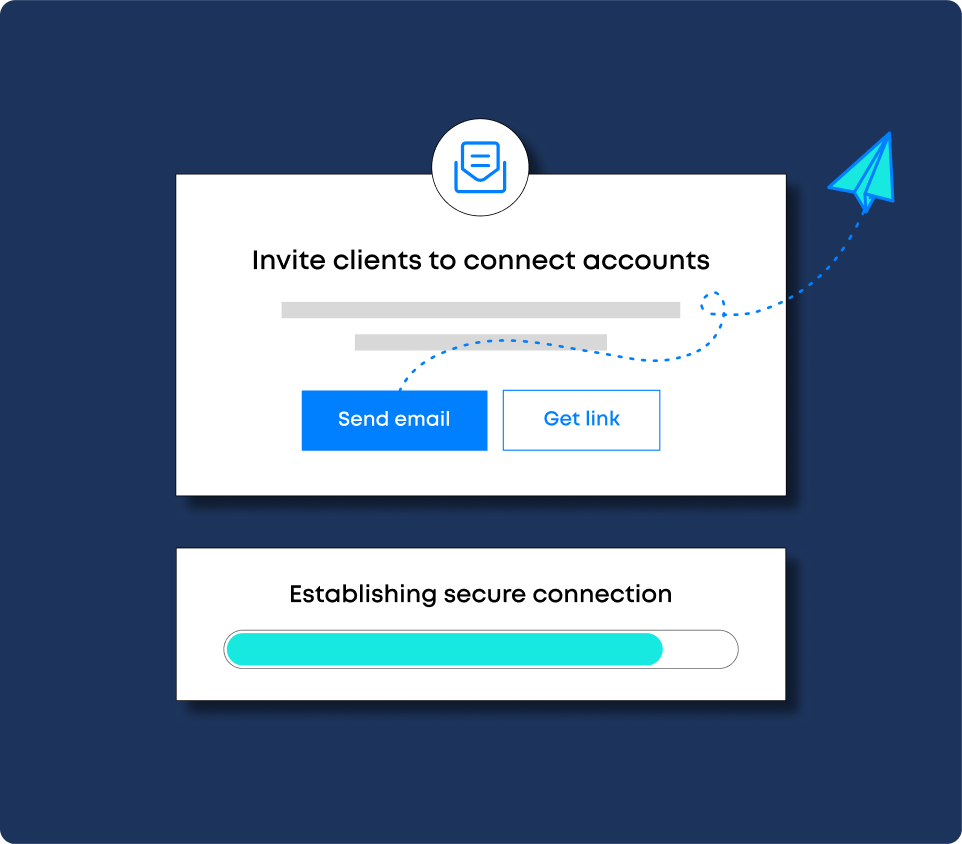

Before Pontera, participants often shared plan account credentials or statements to receive guidance from their financial advisors. Without proper safeguards like Pontera, this practice posed potential cybersecurity risk to participants, advisors, and recordkeepers.

Pontera improves such processes by offering a protective barrier to the client's account and an auditable activities tracker for the advisors. The Pontera platform uses bank-level encryption, is SOC 2 certified by EY, is subject to regular penetration testing, and restricts advisor actions to investment management without ability to withdraw funds, change beneficiaries or otherwise divert any funds.

Disclaimer

With Pontera, an advisor never holds, either directly or indirectly, client funds or securities or has any authority to obtain possession of them. Pontera’s platform is purpose-built to avoid activities that can trigger custody. An advisor never has access to clients’ login credentials when using Pontera. Similar to other data aggregators that are widely used by advisors to connect with their clients’ held-away accounts, Pontera only allows the advisors to take specific actions – in our case, to view and rebalance a client’s account. Advisors cannot use Pontera to engage in activities that could trigger custody, such as withdraw or transfer funds, change beneficiaries or contributions, or initiate distributions.

Pontera partners with leading advisory firms